A Complete Information about Inheritance Tax in Texas. How Much is Inheritance Tax in Texas. Why is it important to know the tax implications of giving away money or an inheritance.

Inheritance Tax Texas

Though we consider inheritance as gift that shouldn’t incur any charges or have any external interference. This doesn’t apply in various States in America. The government, through verified tax departments, impose the standard taxes for inherited property.

However, Texas a popular and nice State to live in, doesn’t tax residents on inheritance tax. Estate owners seeking to pass their property to eligible heirs don’t need to worry about tax remittance.

Why is it important to know the tax implications of giving away money or an inheritance?

What is inheritance tax?

Inheritance tax also means death tax or estate tax. It’s a legal tax levy imposed at State and Federal level. The tax is generalized on property or assets which are (being) transferred from one owner to another (who is not a spouse of the deceased) during their final moments. Texas State doesn’t collect inheritance tax ranking among 38 U.S. States. However, the same may apply on federal level.

Why impose inheritance tax?

Government and tax departments collect and utilize different taxes to improve the State. Inheritance tax also comes in handy in the following ways?

- Inheritance tax helps in servicing different government/ State utilities and programs.

What is probate?

Since Texas State doesn’t require user to pay the estate tax levy. Once the property is released to the legal heir upon the death of the property owner. The legal heir now processes the inheritance through a procedure known as probate. This process helps determine the heir based on the owner’s will or through court proceedings if there is no written will.

Why doesn’t Texas State charge the inheritance tax?

Regardless of the amount received, Texas State doesn’t collect estate tax from the residents. The new property owner is not charged for income tax, state tax or capital gains tax. Texas government believe the same will be charged on the user’s final tax returns.

Factors that determine estate inheritances tax

Here are various numbers of inheritance factors and priorities;

- State law.

- Designated beneficiaries.

- Legal family relationships.

- Executor discretion.

- Wishes expressed in a will.

Process to Inheritance Taxed

In this case, if a loved one dies and leaves money or assets, the inheritance is taxed, often depending on your state or the deceased state. However, the amount that you owe on inheritances can depend on various range of factors like;

- Your relationship with the deceased individuals.

- Size of the estate.

- Tax laws in your state.

Federal Tax

With the inheritance, the tax burden shoved off on the State level. Property (Estate) owners and heirs need to consider whether their inheritance qualifies for taxation at the federal level. To ensure you don’t collide with tax regulations laws. It’s advisable to involve professional Estate tax attorneys to avail the right details.

The federal tax applies when the inherited property goes within or beyond the net value of individual’s property. The assets or estate will, therefore, qualify for federal estate tax. In 2022, if residents have $12.06 million as inheritance, the amount doesn’t qualify as federal. However, anything beyond the set amount is eligible for estate tax.

Ways to Avoid or Reduce the Federal Estate Tax

If you want to reduce your estate taxes before any, you can check some various tactics to use to protect your property;

- Using your asset to enjoy wealth before dying.

- Relocating to a more favourable tax environment.

- Shielding your assets in a trust.

- Giving away your estate taxes.

Things to watch out for: capital gains tax

- If you inherit or bequeath something after subsequent earnings. The income that is produced may be considered taxable capital gains at the federal and state level.

- If your heirs sell an asset they inherited, any profile could be taxed as a long-term or short-term capital gain, depending on when they dispose of the property.

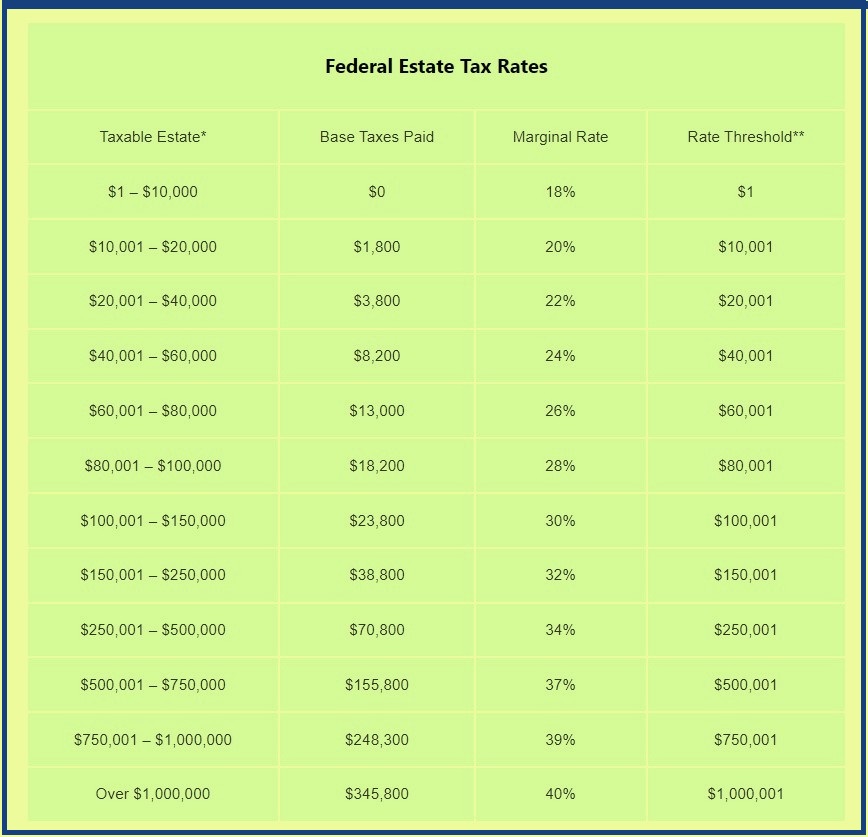

Methods to Calculate Federal Estate Tax

Due to different inheritance tax rules by states, the rate taxed can vary and be calculated differently, as shown below;

- The estate tax rate is 40 % with a based payment of $345800 on the first $ 1,000,000 of the estate.

- If your estate is 1756000, you are charged to pay &545800 in federal state taxes.

- The returned form will be filed within nine months of your deceased unless the IRS grants an extension.

- The inheritance taxes are calculated based on the relationship between the beneficiary and the deceased individual.

How to Plan Trusts & Will and inheritance law in Texas

With an experienced estate planning lawyer, they can help you plan for future without adding any hassle or expenses. However, with an estate planning attorney, you can;

- Designate heirs.

- Set up trusts.

- Ensure your final income tax is complete after death.

- Support your children or spouse after death.

- Help you to budget your assets eligible for the federal tax rate.

- Appoint an executor, trustee or a personal representative of your estate.

States and amount of the inheritance tax in Texas

Here are six states with inheritance taxes and how much each state rate ranges as stated below;

- Pennsylvania: 4.5% to 15%

- New Jersey: 111% to 16%

- Nebraska.:1 % to 18%

- Maryland:10%

- Kentucky:4 % to 16%

- Iowa:2% to 6%

FAQ’S

- What are the two types of trusts in inheritance tax?

- Irrevocable

- Revocable trust.

- How much should I pay for my estate tax in Texas State?

Texas State U.S. doesn’t charge for inheritance tax.